€99

- The IBC Name or/and IBC No. for the desired Offshore Company, please specify in the checkout of the order

- Processing time approx. 1-3 business days

What is the purpose of this certificate

and how do I obtain it?

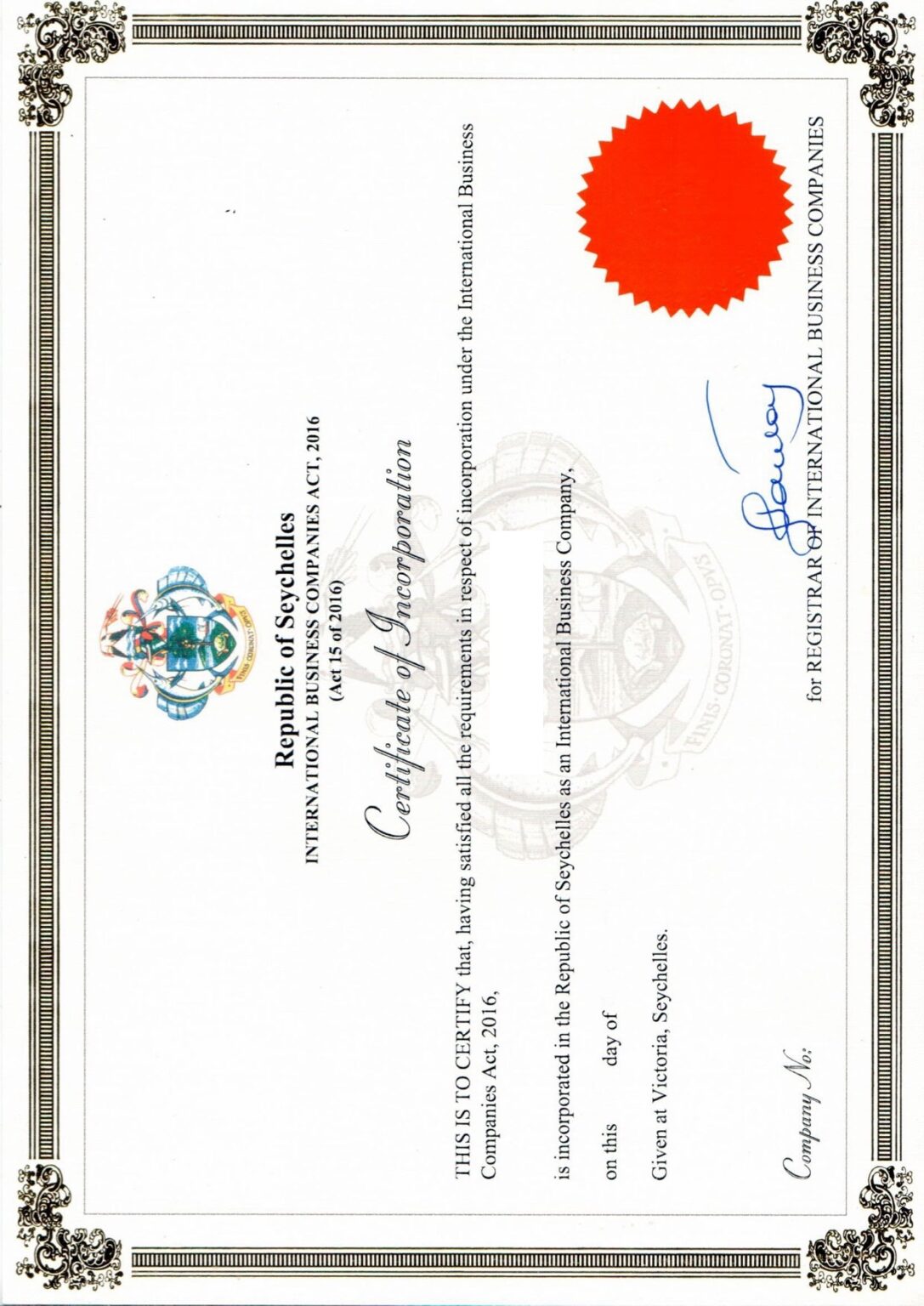

The Certificate of Incorporation in Seychelles is a foundational document issued by the Seychelles Registrar of Companies, (Financial Services Authority, FSA), signifying the legal establishment of a new company or business entity within the jurisdiction of Seychelles.

Do you need a original replacement / copy of a Certificate of Incorporation?

The FSA (Financial Services Authority) of the Seychelles have the possibility to issue a new Certificate of Incorporation for any company in the Seychelles.

The official replacement of a Certificate of Incorporation are Issued by the Seychelles Registrar of Companies (FSA).

Anyone can apply for the certificate through us.

Public Records: Individuals and organizations may request a Certificate of Incorporation for personal or research purposes, such as genealogy research, historical investigations, or academic studies. The certificate provides reliable information sourced from official records maintained by the Registrar of Companies.

Any question? Please contact us.

Certificate of Incorporation, this is included:

-

- Seychelles offshore company incorporation date

- IBC registration number of Seychelles Offshore Company

- The above-mentioned company was duly incorporated under the International Business Companies Act, 2016, founded.

- The name of the Company

- Signed and authorized by the Seychelles Registrar of Companies

- Can be optionally equipped with a Apostille be issued by the Supreme Court of the Seychelles

- The certificate is sent as a PDF in an email and can also be sent as an original and official printout at an optional cost via DHL Worldwide Express Courier

(You can add DHL during the order process) - Processing time of the Certificate of Incorporation approx. 1-3 working days

-

The IBC Name or/and IBC No. for the desired IBC, please specify in the checkout of the order

Apply of the Certificate of Incorporation

Everybody can apply, not just the company founder or owner. You can obtain the deed/certificate in respect of registered IBCs by providing us with either the company name and/or company number.

How to receive the Replacement Certificate:

Upon successful order of the certificate, the Registrar of Companies (FSA) will issue the replacement Certificate of Incorporation. This document will typically include details such as the company’s name, registration number, date of incorporation.

This certificate is optionally notarized with an Hague apostille should it need to be presented abroad. This ensures that the document is officially recognized as a Seychelles certificate. An apostille legalizes documents for international use so that they are recognized under the Hague Convention.

Hague Apostille from the Seychelles

An Apostille in Seychelles for the Certificate of Incorporation serves as a vital form of authentication for documents intended for use in foreign countries that are parties to the Hague Apostille Convention. This international treaty simplifies the process of certifying the authenticity of documents exchanged between member countries by eliminating the need for further legalization or consular authentication. Understanding the Apostille process in Seychelles is crucial for individuals and businesses engaged in international transactions or legal proceedings.

The Apostille process in Seychelles is governed by the Seychelles Ministry of Foreign Affairs and Transport. The Ministry is responsible for issuing Apostilles for various types of documents, including birth certificates, marriage certificates, educational diplomas, powers of attorney, and company registration documents. These Apostilles validate the signatures and seals affixed to these documents, confirming their authenticity for use abroad.

The Supreme court of Seychelles will issue an Apostille certificate, which is attached to the document or presented separately. The Apostille certificate confirms that the signature and seal on the document are genuine and have been duly authenticated by the Seychelles authorities.

It serves as a certification of the document’s authenticity and ensures its recognition and acceptance in countries that are parties to the Hague Apostille Convention.

Once an Apostille has been affixed to a document, it is considered legally valid for use in any other member country of the Hague Apostille Convention. This simplifies the process of presenting documents in foreign jurisdictions, as there is no need for further legalization or consular authentication.

Summary of a Hague Apostille from Seychelles:

In summary, an Apostille in Seychelles for the Certificate of Incorporation is a crucial form of authentication that verifies the authenticity of documents for use in foreign countries. By obtaining an Apostille for their documents, individuals and businesses can ensure their legal validity and facilitate their acceptance in international transactions and legal proceedings. Understanding the Apostille process and its requirements is essential for anyone seeking to use Seychellois documents abroad or to accept foreign documents in Seychelles with confidence and efficiency.

About the FSA in the Seychelles

The Financial Services Authority (FSA) in Seychelles plays a pivotal role in regulating and supervising the financial services sector within the jurisdiction. Established under the Financial Services Authority Act of 2013, the FSA serves as the primary regulatory body responsible for ensuring the stability, integrity, and transparency of Seychelles’ financial system. With a mandate encompassing various financial services, including banking, insurance, securities, and mutual funds, the FSA functions as a comprehensive regulatory authority aimed at fostering a sound and competitive financial services industry.

The FSA operates under the oversight of the Ministry of Finance, Trade, Investment, and Economic Planning, aligning its activities with national economic policies and regulatory objectives. Its overarching mission revolves around maintaining the safety and soundness of financial institutions, protecting investors and consumers, and promoting market integrity and financial inclusion.

One of the core functions of the FSA is to license and supervise financial institutions operating within Seychelles. This includes banks, insurance companies, securities dealers, investment advisers, and other entities engaged in financial intermediation. By setting stringent licensing requirements and conducting ongoing supervision, the FSA aims to ensure that these institutions operate prudently, adhere to relevant laws and regulations, and maintain high standards of corporate governance and risk management.The FSA also generates all official certificates, such as the Certificate of Incorporation.

In addition to licensing and supervision, the FSA plays a vital role in formulating and enforcing regulations governing the conduct of financial services providers. These regulations cover a wide range of areas, including anti-money laundering and counter-terrorism financing (AML/CFT) measures, customer due diligence, market conduct standards, and prudential requirements. By establishing clear rules and standards, the FSA seeks to promote market discipline, protect consumers from financial abuse, and enhance the overall stability and integrity of the financial system.

Moreover, the FSA serves as the primary authority for promoting investor education and consumer awareness in Seychelles. Through various outreach programs, seminars, and publications, the FSA educates the public about financial products, investment risks, and consumer rights. By empowering individuals to make informed financial decisions, the FSA aims to enhance financial literacy, foster trust in the financial system, and safeguard the interests of investors and consumers.

Another crucial aspect of the FSA’s mandate is to facilitate the development and growth of Seychelles’ financial services industry. This includes promoting innovation, encouraging investment, and creating an enabling regulatory environment for financial innovation and technology (FinTech) initiatives. By embracing technological advancements and supporting innovative business models, the FSA seeks to enhance the competitiveness and resilience of Seychelles’ financial sector in the global marketplace.

Summary about the FSA:

In summary, the Financial Services Authority (FSA) in Seychelles plays a multifaceted role in regulating and supervising the financial services industry. Through its licensing, supervision, regulation, and consumer protection functions, the FSA strives to promote financial stability, market integrity, investor confidence, and sustainable economic growth. As Seychelles continues to position itself as an international financial center, the FSA remains committed to upholding the highest standards of regulatory excellence and contributing to the long-term prosperity and resilience of the jurisdiction’s financial system.

More information about the Seychelles Business Register you will find here: Seychelles Business Register