Seychelles Business Register

Exploring the Business Landscape of Seychelles

Introduction

The Seychelles, an archipelago in the Indian Ocean, is renowned for its breathtaking beauty, crystal-clear waters, and pristine beaches. Beyond its allure as a tourist paradise, the Seychelles has established itself as a significant player in the global business arena, particularly in the realm of offshore finance. This comprehensive guide delves into various facets of the business environment in Seychelles, covering key topics such as business extracts, business registers, business searches, and the essential certificates that facilitate business operations. We will also explore the roles of the Financial Services Authority (FSA), International Business Companies (IBCs), and the overall framework that supports offshore companies in Seychelles.

Seychelles Business Extract

What is a Business Extract?

A business extract is an official document that provides a snapshot of a company’s registered details. It typically includes information such as the company’s name, registration number, date of incorporation, registered office address. This document is essential for various legal and administrative purposes, including verifying the existence of a company, conducting due diligence, and facilitating business transactions.

Importance of Business Extracts in Seychelles

In Seychelles, obtaining a business extract is a crucial step for anyone looking to engage with local companies. Whether you are an investor, a potential business partner, or a regulatory authority, a business extract serves as a reliable source of verified information about a company. It ensures transparency and helps build trust in the business environment.

How to Obtain a Business Extract

To obtain a business extract in Seychelles, you can see at our online shop different certificates. The requested certificate can usually be delivered electronically via eMail as PDF or in paper format shipped with DHL worldwide express, depending on the applicant’s preference.

Seychelles Business Register

Understanding the Seychelles Business Register

The Seychelles business register is a comprehensive database maintained by a government authority that contains detailed information about all registered businesses within a jurisdiction. In Seychelles.

The Role of the Seychelles Business Register in Seychelles

The Seychelles business register plays a pivotal role in maintaining the integrity and transparency of the business sector. It ensures that all companies comply with local regulations and provides a publicly accessible platform for verifying company details. This is particularly important for international investors and businesses seeking to engage with local entities.

Accessing the Seychelles Business Register

Accessing the Seychelles business register in Seychelles is a not so easy. Because the Registrar of Companies (Financial Services Authority) provides not an online portal where users can search for and retrieve information about registered IBC companies, just local business, where you can see at the Commercial Register Seychelles.

But you can apply a Certificate of Official Search and can get the Informationen of an Seychelles IBC.

Business Search

Conducting a Business Search

A business search involves querying the business register to obtain information about a specific company. This process is essential for due diligence, background checks, and verifying the legitimacy of a business entity. In Seychelles, business searches can be conducted online through the Registrar of Companies’ portal.

Types of Information Available Through Business Search

When conducting a business search in Seychelles, you can expect to find various types of information, including the company’s name, registration number, date of incorporation, registered office address. Some searches may also provide information about the company’s financial status and any legal proceedings it may be involved in.

Importance of Business Search

Conducting a business search is a critical step in mitigating risks associated with business transactions. It provides assurance that the company you are dealing with is legitimate and compliant with local laws. This is particularly important in Seychelles, given its prominent role in the offshore finance sector.

Certificate of Good Standing | Seychelles

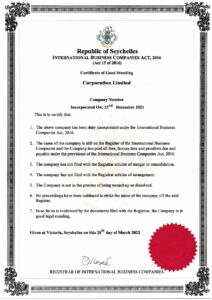

What is a Certificate of Good Standing?

A Certificate of Good Standing is an official document issued by the Registrar of Companies that certifies a company is legally registered and compliant with all its statutory obligations. This certificate indicates that the company is in good standing with the regulatory authorities and has not been subject to any penalties or legal actions.

Importance of Certificate of Good Standing in Seychelles

In Seychelles, a Certificate of Good Standing is often required for various business activities, including opening bank accounts, entering into contracts, and establishing business partnerships. It serves as proof that the company is reputable and adheres to all regulatory requirements.

How to Obtain a Certificate of Good Standing

To obtain a Certificate of Good Standing in Seychelles, you can apply here. The Certificate of Good Standing can usually be delivered electronically via eMail as PDF or in paper format shipped with DHL worldwide express, depending on the applicant’s preference.

Certificate of Incorporation | Seychelles

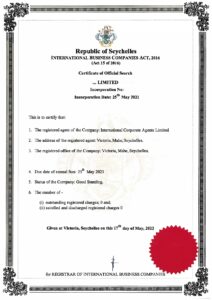

Understanding the Certificate of Incorporation

A Certificate of Incorporation is a legal document that officially recognizes the formation of a company. It is issued by the Registrar of Companies upon the successful registration of a new business entity. This certificate includes key details such as the company’s name, registration number, date of incorporation, and the type of entity (e.g., limited liability company, international business company).

Significance of the Certificate of Incorporation in Seychelles

In Seychelles, the Certificate of Incorporation is a fundamental document that marks the legal existence of a company. It is required for various administrative and legal processes, including opening bank accounts, signing contracts, and applying for licenses. The certificate serves as proof that the company is duly registered and authorized to operate within the jurisdiction.

Process of Obtaining a Certificate of Incorporation

The process of obtaining a Certificate of Incorporation in Seychelles involves submitting the necessary documentation to the Registrar of Companies, including the company’s memorandum and articles of association, details of directors and shareholders, and the registered office address. Upon approval, the Registrar issues the Certificate of Incorporation, officially recognizing the company as a legal entity.

Certificate of Official Search | Seychelles

What is a Certificate of Official Search?

A Certificate of Official Search is an authenticated document that provides the results of a detailed search conducted in the business register. This certificate includes comprehensive information about a company’s status, but not of its directors and shareholders and any other protected data recorded in the register.

Uses of a Certificate of Official Search in Seychelles

In Seychelles, a Certificate of Official Search is commonly used for due diligence, legal proceedings, and verifying the status of a company. It is an essential tool for investors, legal professionals, and regulatory authorities to ensure transparency and compliance with local laws.

How to Obtain a Certificate of Official Search

To obtain a Certificate of Official Search in Seychelles, you can apply here. The Certificate of official Search can usually be delivered electronically via eMail as PDF or in paper format shipped with DHL worldwide express, depending on the applicant’s preference. The process involves a thorough examination of the business register, and the certificate is issued upon completion of the search, providing the requested information.

Company Search

Conducting a Company Search

A company search involves investigating the details of a specific company through the business register. This search provides vital information about the company’s legal status, ownership structure, financial health, and compliance with regulatory requirements. In Seychelles, company searches can be performed online or through formal requests to the Registrar of Companies.

Importance of Company Search in Seychelles

Company searches are crucial for various stakeholders, including investors, business partners, and regulatory authorities. They provide assurance that the company is legitimate and adheres to local regulations. In Seychelles, where the business environment includes numerous international business companies (IBCs) and offshore entities, company searches are particularly important for ensuring transparency and trust.

Steps to Conduct a Company Search

To conduct a company search in Seychelles, you can use the online portal provided by the Registrar of Companies or submit a formal request. The search results typically include the company’s name, registration number, date of incorporation, registered office address, and details of its directors and shareholders. Additional information may be available depending on the depth of the search.

Financial Services Authority (FSA)

Overview of the Financial Services Authority

The Financial Services Authority (FSA) is the regulatory body responsible for overseeing and regulating the non-bank financial services sector in Seychelles. This includes the licensing and supervision of international business companies (IBCs), trust companies, insurance companies, and other financial service providers. The FSA ensures that these entities comply with local laws and international standards, promoting a transparent and stable financial environment.

Role of the FSA in Seychelles

The FSA plays a critical role in maintaining the integrity and reputation of Seychelles as a global financial center. It enforces regulatory compliance, conducts regular inspections and audits, and takes enforcement actions against non-compliant entities. The FSA also works to enhance the regulatory framework, keeping it aligned with international best practices and standards.

Services Provided by the FSA

The FSA provides various services, including the licensing and regulation of financial service providers, the registration of international business companies (IBCs), and the issuance of certificates of good standing. It also offers guidance and support to businesses operating within its jurisdiction, helping them navigate regulatory requirements and ensure compliance.

International Business Company (IBC)

Understanding International Business Companies

An International Business Company (IBC) is a legal entity incorporated under the International Business Companies Act in Seychelles. IBCs are designed for international business activities and are exempt from local taxes on income derived outside of Seychelles. They are popular for various business purposes, including holding assets, conducting international trade, and managing investments.

Benefits of Incorporating an IBC in Seychelles

Incorporating an IBC in Seychelles offers numerous benefits, including tax efficiency, confidentiality, and a streamlined incorporation process. IBCs enjoy a favorable regulatory environment with minimal reporting requirements, making them an attractive option for international investors and entrepreneurs.

Incorporation Process of an IBC

The incorporation process of an IBC in Seychelles involves submitting the necessary documents to the Registrar of Companies, including the company’s memorandum and articles of association, details of directors and shareholders, and the registered office address. Upon approval, the Registrar issues a Certificate of Incorporation, officially recognizing the IBC as a legal entity. The entire process is efficient and can often be completed within a few days.

Offshore Company | Seychelles

What is an Offshore Company?

An offshore company is a business entity registered in a jurisdiction different from where its principal operations are conducted. Offshore companies are often used for tax planning, asset protection, and international business activities. Seychelles is a popular jurisdiction for establishing offshore companies due to its favorable regulatory environment and tax advantages.

Advantages of Establishing an Offshore Company in Seychelles

Establishing an offshore company in Seychelles offers several advantages, including tax exemption on foreign-sourced income, confidentiality, and asset protection. Seychelles’ robust legal framework and stable political environment also provide a secure and reliable base for offshore business operations.

Incorporation and Compliance Requirements

The incorporation of an offshore company in Seychelles involves submitting the necessary documentation to the Registrar of Companies. This includes the company’s memorandum and articles of association, details of directors and shareholders, and the registered office address. Offshore companies in Seychelles must comply with local regulations, including maintaining proper records and filing annual returns. However, they benefit from a relatively low regulatory burden compared to onshore entities.The setup of incorporating a Offshore Company (IBC), you find here.

Seychelles Business Register: An In-Depth Analysis

Table of Contents

- Introduction

- Importance of the Seychelles Business Register

- Historical Context

- Evolution of Business Registration in the Seychelles

- Key Milestones

- Legal Framework

- Laws Governing Business Registration

- Regulatory Bodies

- Business Registration Process

- Steps to Register a Business

- Required Documentation

- Registration Fees

- Types of Business Entities

- Sole Proprietorships

- Partnerships

- Limited Liability Companies

- Offshore Companies

- Trusts and Foundations

- Benefits of Registering a Business in the Seychelles

- Tax Incentives

- Confidentiality

- Legal Protections

- Challenges and Considerations

- Regulatory Compliance

- Operational Challenges

- Market Entry Barriers

- Case Studies

- Success Stories

- Lessons Learned

- Future Outlook

- Upcoming Reforms

- Predictions for Business Growth

- Conclusion

Importance of the Seychelles Business Register

The Seychelles Business Register serves as the official repository of information on all registered businesses within the country. It is a vital tool for ensuring transparency, legal compliance, and fostering a conducive environment for economic activities. This comprehensive database aids in the regulation of business practices, provides essential data for policymakers, and serves as a reliable resource for investors and entrepreneurs.

Historical Context

Evolution of Business Registration in the Seychelles

Business registration in the Seychelles has evolved significantly over the past few decades. Initially, the process was rudimentary and manual, with limited regulatory oversight. However, with the advent of digital technology and globalization, the need for a more robust and transparent system became evident. The introduction of the Seychelles International Business Authority (SIBA) in 1995 marked a turning point, streamlining the registration process and enhancing regulatory frameworks.

Key Milestones

- 1995: Establishment of the Seychelles International Business Authority (SIBA).

- 2003: Introduction of the Companies Act, providing a modern legal framework for business entities.

- 2011: Launch of the online business registration portal, simplifying the registration process.

- 2014: Implementation of the Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) regulations, ensuring compliance with international standards.

Legal Framework

Laws Governing Business Registration

The primary legislation governing business registration in the Seychelles includes the Companies Act, the International Business Companies Act, the Limited Partnerships Act, and the Trusts Act. These laws provide a comprehensive framework for the formation, operation, and dissolution of various business entities, ensuring legal certainty and protection for all stakeholders.

Regulatory Bodies

The Financial Services Authority (FSA) is the principal regulatory body overseeing business registration in the Seychelles. Established under the Financial Services Authority Act, the FSA is responsible for licensing, supervision, and enforcement of compliance with regulatory requirements. The Registrar of Companies, a division within the FSA, manages the Seychelles Business Register and ensures adherence to statutory obligations.

Business Registration Process

Steps to Register a Business

Registering a business in the Seychelles involves several key steps:

- Name Reservation: Check the availability of the desired business name and reserve it with the Registrar of Companies.

- Preparation of Documentation: Prepare the necessary documents, including the Memorandum and Articles of Association, and other required forms.

- Submission of Application: Submit the application and accompanying documents to the Registrar of Companies.

- Payment of Fees: Pay the applicable registration fees.

- Issuance of Certificate: Upon approval, the Registrar issues a Certificate of Incorporation, signifying the legal formation of the business.

Required Documentation

The specific documents required for business registration vary depending on the type of entity. Commonly required documents include:

- Memorandum and Articles of Association

- Proof of identity and address for directors and shareholders

- Declaration of compliance with regulatory requirements

- Payment of registration fees

Registration Fees

Registration fees in the Seychelles are competitive and vary based on the type of business entity. The fees are designed to cover administrative costs and contribute to the maintenance of the Seychelles Business Register.

Types of Business Entities

Sole Proprietorships

A sole proprietorship is the simplest form of business entity, owned and operated by a single individual. It offers ease of formation and minimal regulatory requirements, making it an attractive option for small businesses and entrepreneurs.

Partnerships

Partnerships involve two or more individuals or entities coming together to conduct business. The Seychelles recognizes general partnerships and limited partnerships, each with distinct legal and operational characteristics.

Limited Liability Companies

Limited Liability Companies (LLCs) are popular for their flexible structure and limited liability protection for shareholders. They can be privately held or publicly traded and are subject to the provisions of the Companies Act.

Offshore Companies

The Seychelles is a preferred jurisdiction for offshore companies, thanks to its favorable tax regime and robust confidentiality provisions. Offshore companies are typically used for international trade, investment, and asset protection.

Trusts and Foundations

Trusts and foundations offer unique advantages for wealth management and estate planning. The Seychelles Trusts Act and Foundations Act provide a solid legal framework for these entities, ensuring confidentiality and asset protection.

Benefits of Registering a Business in the Seychelles

Tax Incentives

The Seychelles offers attractive tax incentives for businesses, including exemptions from income tax, capital gains tax, and withholding tax for offshore companies. These incentives are designed to stimulate economic growth and attract foreign investment.

Confidentiality

Confidentiality is a key advantage of registering a business in the Seychelles. The country has strict privacy laws that protect the identities of business owners and shareholders, ensuring a high level of confidentiality.

Legal Protections

The Seychelles’ legal system provides robust protections for businesses, including property rights, contract enforcement, and dispute resolution mechanisms. This legal certainty fosters a stable and predictable business environment.

Challenges and Considerations

Regulatory Compliance

Compliance with regulatory requirements is essential for businesses operating in the Seychelles. Failure to adhere to legal and regulatory obligations can result in penalties, fines, and even dissolution of the business.

Operational Challenges

While the Seychelles offers numerous advantages, businesses may face operational challenges such as limited access to skilled labor, high transportation costs, and dependence on imported goods and services.

Market Entry Barriers

Entering the Seychellois market can be challenging for foreign businesses due to regulatory complexities, cultural differences, and competitive dynamics. Thorough market research and strategic planning are crucial for successful market entry.

Case Studies

Success Stories

Several businesses have successfully established operations in the Seychelles, leveraging the country’s favorable business environment and strategic location. Notable success stories include international financial services firms, tourism ventures, and innovative tech startups.

Lessons Learned

Analyzing the experiences of successful businesses in the Seychelles provides valuable insights and lessons for new entrants. Key takeaways include the importance of regulatory compliance, the benefits of local partnerships, and the need for adaptability and resilience.

Future Outlook

Upcoming Reforms

The Seychelles government is committed to continuous improvement of the business environment. Upcoming reforms include enhancements to the business registration process, increased transparency measures, and initiatives to attract more foreign investment.

Predictions for Business Growth

The future outlook for business growth in the Seychelles is promising. The country’s strategic location, progressive policies, and commitment to sustainable development position it well for continued economic expansion and increased foreign investment.

Conclusion

The Seychelles offers a compelling business environment for both local and international entrepreneurs. With its robust regulatory framework, efficient business registration processes, and attractive tax incentives, Seychelles has positioned itself as a leading jurisdiction for offshore finance and international business activities. Understanding the various aspects of business operations in Seychelles, including obtaining essential certificates and conducting thorough business searches, is crucial for anyone looking to engage with this vibrant market. The Financial Services Authority (FSA) plays a pivotal role in maintaining the integrity and stability of the financial sector, ensuring that Seychelles remains a trusted and reputable destination for business. Seychelles Business Register.